Banks Can’t Afford to Ignore These Mobile Features

In a recent survey into mobile banking in the U.S., Mobile Banking Competitive Edge, Business Insider Intelligence found that 61 percent of respondents said they would change banks due to a poor mobile banking experience.

Let that sink in. Customer churn in personal banking is not like switching, say, supermarket brands. Traditionally, people choose banks with the long view in mind, which is why it is so interesting that nearly two thirds of people now see the mobile experience as so crucial that they would not only choose a bank based on those features, but willingly go through the administrative upheaval to access them.

Pocket banking

Smartphones forever changed the way people interact with their banks. It’s easy to access many banking services regardless of time or place, with diminishing need to set foot into a physical, brick-and-mortar bank. This is just as well, as local bank branches are now closing faster than ever.

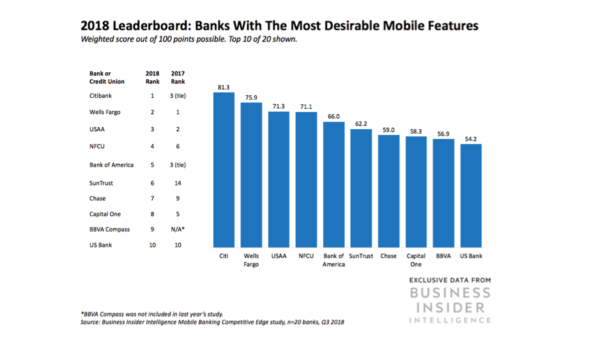

So it’s no surprise that spending in mobile banking is rocketing. Features such as voice assistants and voice recognition ID are on the rise. Increasingly sophisticated features, as evidenced by Business Insider’s top five, are now setting the pace that the rest of the pack must follow.

Creating a system of digital delivery that manages to be nimble, agile, accessible and instantly appealing, while also meeting the highest security and privacy regulations, doesn’t happen by accident! Let’s take a closer look at the findings from Business Insider Intelligence’s report of the most in-demand mobile features in the U.S.

Keeping customers at the center of the mobile banking experience

Dig a little deeper into the features that set apart the banks on the report leaderboard and it becomes clear that fancy innovations alone don’t cut it. The features that matter most are those pioneering updates that have the customer’s best experience as the driver. They include such developments as biometric access (Citibank), spending analytics (Wells Fargo) and the ability to change a debit card PIN (USAA), to name a few.

Integrating the latest, best technologies… fast

A special call-out went to Wells Fargo for its cutting-edge technologies, such as the recent feature enabling AI-driven spending insights. Special mention also went to Bank of America for its voice-assistant, Erica. A trend that was evident across the whole leaderboard was the successful – and fast – adoption of technologies such as AI, predictive analytics, natural language processing and machine learning.

Security

High-profile data breaches like Equifax continue to keep security and privacy issues high up on the agenda for many consumers. “Security and control” was a key category for the mobile banking research, one topped by Wells Fargo in this year’s report.

What do they have in common?

When market competition is fierce, the tendency is to scrutinize what sets different companies’ offerings apart. Another way to look at the same group of companies is to examine what these organizations are doing right, and how others could learn from them. In the Mobile Banking Competitive Edge Report, the pace-setters that make it onto the leaderboard are those organizations that have successfully re-engineered the customer experience – digitally.

Apexon has a proven track record of implementing end-to-end mobile strategies for financial services firms, from initial strategy and planning, through delivery and support. To find out how our deep expertise, processes and tools could help your digital initiatives deliver results, fill out the form below.

View our recent DTV interview on ‘Payments’ with our customer – Wirecard!