Can checkout experience reduce payment disputes?

I’ve only occasionally found transactions on my statement that I couldn’t recognize, prompting me to contact the merchant or the bank. The customer service representative provided the necessary information, helping me understand the transaction better and determine if it was fraudulent or legitimate. Once I decided to dispute the transaction, the key was that I received frequent updates until the issue was resolved.

The Consumer Financial Protection Bureau recently levied an $89 million fine on two major brands for improperly handling customer disputes over card transactions. The fines stem from allegations that one of the brands failed to clearly communicate payment terms to its customers.

Also Read: Data-Driven CX: Tackling Friendly Frauds & Enhancing Satisfaction

Abby Thomas, Chief Executive and Chief Ombudsman at The Financial Ombudsman Service said that “Businesses should put consumers at the heart of their service but the high level of complaints we receive shows that’s not always the case.”

Brands must prioritize transparency for the customers, ensuring they provide all necessary information to help them make informed decisions.

Card providers handle over 150 million disputes annually, attributing this surge to the growth of e-commerce and insufficient controls.

The chargeback season

Fraud practitioners refer to the first few months of the year as ‘chargeback season,’ a period marked by a surge in disputes following holiday purchases.

Categories of Payment Disputes

Importance of Checkout Experience

It is estimated that 20% of customers abandon a purchase due to lack of trust with the checkout process. This highlights the emphasis that Brands are putting to improve the Checkout Experience to reduce loss of sale and improve customer satisfaction.

The journey from selecting a Product to clicking “Confirm Order” is crucial and additional information on each step helps the customer make a very informed buying decision.

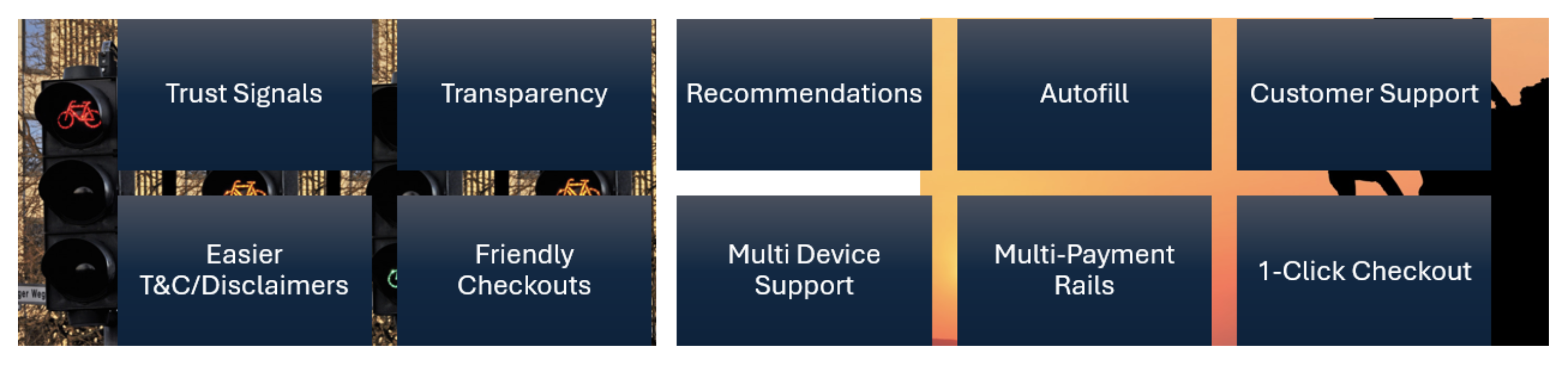

Brands are adopting several ways to improve the Checkout Experience from making simpler checkout pages to adding Trust Signals throughout the process.

Way ahead…

A reversed transaction (for any reason) or a returned item, is loss of business and unsold inventory. While the return policies and disputes are necessary to protect the customer rights, everyone in this cycle must work together to plug the gaps and enhance the experience for brands, merchants, customers, banks.

Also Read: How AI TRiSM Will Radically Change the Way We Live – Apexon

Merchants and banks should implement solutions that are customer-friendly to improve the shopping experience and enhance customer loyalty.

With the exponential growth in digital payments, the number of disputes is expected to increase. Brands and merchants that adopt data analytics-driven, customer-centric solutions with AI assistance can significantly reduce chargebacks.