Digital Transformation Guide for the Insurance Industry

Not sure if your insurance organization is ready for digital transformation?

You’re in the right place.

Do any of the following apply to your company?

- Insurtech startups are encroaching on your customers

- Employees have to perform repetitive manual tasks to do their jobs

- Data is stored in several unconnected hubs (CRM, spreadsheets, email, claims database, etc.)

- If certain key employees left, you’d be in trouble

- There’s no time for big projects because you’re always busy putting out fires

- You’re seeing diminishing returns from work you’ve always done

If you answered “yes” at least once, you’re ready for digital transformation.

But what does “digital transformation” look like in the insurance industry?

- Employees are free to do higher-value work

- All your data lives in one place – a single source of truth

- Nobody is a single point of failure

- You have bandwidth to launch innovative new initiatives

- You can act when you discover new sources of revenue

- You can easily adapt your processes as needs and customer behaviors change

- Customers are happier

- Employees feel less burnt out

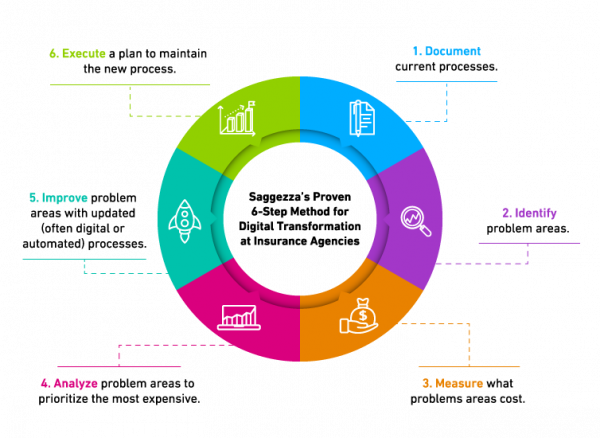

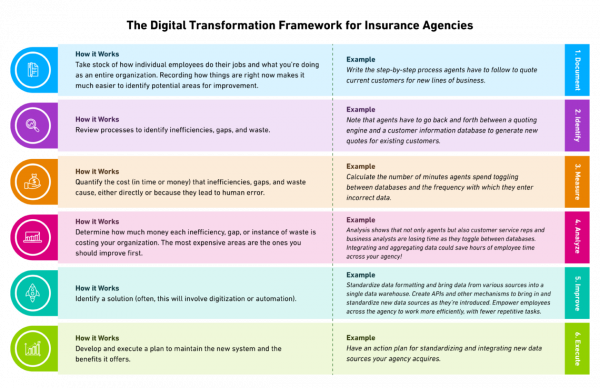

So how can insurance companies get there?

Let’s look at some examples of how these steps might play out at an insurance company.

Digital Transformation Success Stories

Success Story #1: Data Engineering Helps an Insurance Marketing Firm Expand its Network

- The situation: Between summer 2019 and winter 2021, this company made more than 25 mergers and acquisitions. By February 2021, it had…

- 200,000+ marketers

- 60+ offices

- 35+ independent partner offices

- The problem: Every merger and acquisition meant new data sources, formats, and systems. Even though the company was growing, analysts couldn’t easily measure that growth – or where the biggest opportunities lay.

- The solution: Apexon helped this company…

- Standardize its data.

- Build tools that automatically extract and standardize new data so the company can easily scale as it acquires more data.

- Build dashboards that offer real-time reporting.

- The results: Today, the company’s leaders can view various levels of business performance at a glance, which empowers them to make informed business decisions. Further, as the company continues to grow, its new data capabilities will scale with it.

- The takeaway for insurance companies: Unified, standardized data makes high-stakes decision making easier

Success Story #2: A Single Source of Truth Means Faster Decisions for a Healthcare Company

- The situation: A leading and growing healthcare company had data stored in multiple systems, which required employees to process it manually.

- The problem: The dispersed data created several problems for the company…

- Analysts had to log into multiple systems (billing, patient information) to get the data they needed, download it to Excel, and manipulate it manually.

- There was no way to get a complete picture of customers.

- Manual processing meant errors got introduced, which made it nearly impossible for leaders to make business decisions confidently.

- The solution: Apexon helped the company…

- Move its data to a single, cloud-based warehouse.

- Add necessary security and governance protocols.

- Set up automation solutions that produce real-time dashboards to track performance.

- The results: Leaders can now make business decisions quickly and confidently, knowing they’re acting on accurate, up-to-date information.

- The takeaway for insurance companies: A single source of truth streamlines every business process

Success Story #3: A Mid-Market Company Makes a Small Upfront Investment in Innovation Lab-Style Practices to Accelerate Learnings

- The situation: This company had an idea for a new product that would let its customers make better, data-driven decisions faster.

- The problem: To launch the product, the company needed funding approval. But all they had was the idea – nothing tangible to prove its validity.

- The solution: Apexon worked with the company to test the product with a two-week experiment that took less time and fewer resources than a detailed business case would have.

- The results: The experiment showed not only that the core product worked but also that several key features were too complex to include. The company got funding approval to launch the product and saved itself time and money that it would have otherwise spent trying to develop the features that proved non-viable.

- The takeaway for insurance companies: A small investment of time and money can yield valuable discoveries about the best path to pursue

Insurance Industry Digital Transformation in the Headlines

In March 2021, Amazon announced a partnership with Next Insurance to provide small business insurance to eligible members of Amazon Business Prime.

Kin, which uses granular data to craft more accurate home insurance quotes, launched an offering in its third state, Louisiana, in March 2021.

In February 2021, Main Street America Insurance acquired insurtech company Bold Penguin as part of ongoing investments in digital innovation.

In November 2020, insurance broker Brown & Brown acquired insurtech startup CoverHound to better “meet customers where they are.”

How to Start Your Digital Transformation Journey

Is your insurance company ready to…

- Streamline internal processes?

- Make business decisions faster?

- Improve customer experiences?

- Seize new revenue opportunities as soon as they arise?

… if so, get in touch.

We’ll connect you with one of our digital transformation experts who has experience in the insurance industry.

Want to learn more? Contact Us here

![[Un]Stuck in the Middle: The Surprising Catalyst of Digital Transformation](https://s40886.pcdn.co/wp-content/uploads/2022/04/AdobeStock_239828859-scaled.jpeg)