Elevating Payment Experience – Interoperability

It is estimated that 40% of online buyers would abandon the purchase if their preferred payment method were unavailable at the checkout.

Payment is one of the most ancient and fundamental concepts and its implementation in today’s globalized market is increasingly complex.

Brands are prioritizing enhancing the customer buying experience through a variety of payment options. To foster loyalty, brands are enabling traditional and new payment methods.

Also Read: Strengthening Compliance and Reporting Frameworks with Data

The World Bank defines interoperability as “A situation in which payment instruments belonging to a given scheme may be used in platforms developed by other schemes, including in different countries.” The payment interoperability demands a more innovative and inclusive framework as it can enable payment instruments from one system to be used on platforms developed by others and even across borders. This complex concept encompasses various dimensions such as regulatory compliance, monitoring, scalability, privacy, security, and standardization. Today interoperability becomes essential interconnected where transactions often involve multiple parties and systems.

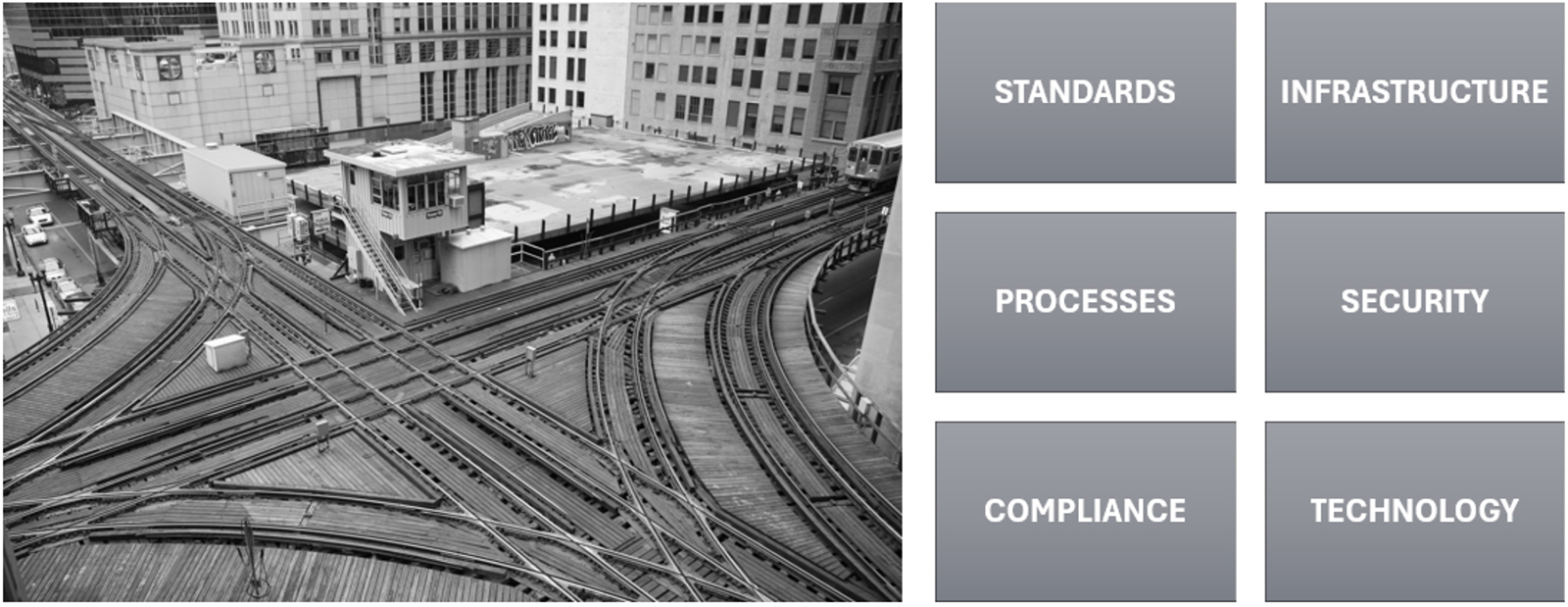

COMMON PROTOCOLS AND STANDARDS: Protocols and methods of inter-communication are an integral part of this massive solution. While there are various formats used globally, there is an increased adoption of the ISO standards (ISO20022). Adoption of a standard method or a mechanism to make discrete A common adoption of a standard format could propel this transformation.

NEXTGEN INFRA: Smart and next-gen switches and networks connecting different payment rails for data exchange and processing will be the backbone.

PROCESSES: Establishing processes and solutions for clearing and settlement between different parties over different rails to ensure.

SECURITY: Robust authentication methods to protect sensitive payment data, using encryption to secure data transmission and storage. Employing fraud detection and prevention measures to safeguard transactions.

Also Read: Transforming Finance with AI: Key Insights from Citi’s GPS Focus Report

REGULATORY: While PCI-DSS PSD2 for core today, the standards and regulations will have to evolve to support cross-operational rails for the governance, accountability, monitoring and transparency.

TECHNOLOGY: Integrating diverse payment systems indeed presents significant technical challenges, primarily due to the variations in their underlying architectures and protocols. While integrating diverse payment systems is technically challenging, it is essential for providing a seamless user experience and supporting a wide range of payment options. With careful planning, robust architecture design, and thorough testing, these challenges can be effectively managed. The solution(s) should consider several generations of architectures, protocols, design, development, validation and compliant.

Also Read: The Rise of Real-Time Payments: The Three I’s for a Seamless Experience

CUSTOMER EXPERIENCE: A positive customer experience in payment interoperability is essential for driving adoption and satisfaction. The payments should be processed smoothly and efficiently, without unnecessary delays or complications and provide a consistent experience across different channels and devices.

CONCLUSION: The evolution of such complex systems hinges on the seamless interactions of diverse payment methods and collaboration amongst many. It is crucial for enhancing the customer experience and fostering brand loyalty.

The evolution of such complex systems depends on a lot of entities that will have to work in cohesion.

Also read: Hyper-Personalization in Banking – The Future of Client Engagement

Also read: Transforming Digital Experiences: How Adobe Experience Manager Powers Modern Business