How Partnering with Apexon Can Enhance an Insurance Company’s Automation Capabilities & Help Achieve Ambitious Goals

Picture this: your customer has just experienced a weather event in their area and are concerned about the potential for damage to their property. They reach for their phone to call your claims department, but before they can dial, their phone rings. When they answer, they’re greeted by one of your claims handlers.

Your claims handler is able to see an estimated range of the cost of property damage and engages the customer in a conversation to narrow down the potential claim estimate.

As the conversation progresses, the agent is able to concentrate entirely on building and maintaining the relationship with your customer while their system automatically interprets the weather event, the property details, and the conversation, and orders the necessary services in the background.

Within hours, the roof has been inspected for damage by one of your local drone operators and a payment has been issued to the customer, without your claims handler needing to order a single service, set any reserves, or order any payments.

Sound like a pipe dream?

It’s much more attainable than you think. Read on to understand how partnering with Apexon can make it possible for your insurance organization to implement the kind of automation-powered digital processes described above (and many others!).

Why Partner with an External Team?

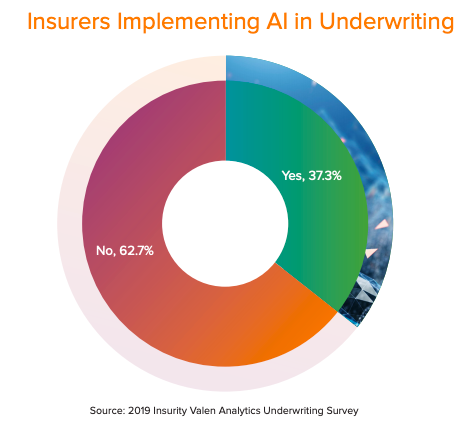

Figure 1: Only 37% of insurance companies use AI in underwriting (source).

If you’re like most established insurance organizations (see Figure 1), you probably have a few hurdles keeping you from realizing automation like what’s in the scenario above:

- Data stored in multiple, siloed databases from years of mergers, acquisitions, and adopting piecemeal technology solutions

- Nobody on staff who has the expertise to lead the project of automating processes – or even the expertise to hire the people who do

- Too many short-term crises to deal with to pull people away to focus on longer-term projects

An external team can solve all of these. When we work with insurance organizations, for example, we bring the following to the table:

- Experience. Our teams have experience not only in doing the work required to get you to your desired end state but also in working with each other and integrating with existing teams.

- Training for your internal team. During the eight weeks to six months it typically takes to launch a digital transformation initiative at an insurance organization, we work side by side with your existing team, so that when we leave, your organization has a group of in-house experts.

- Shorter time to delivery. Because we’ve helped several insurance organizations with digital transformation, we hit the ground running and know how to avoid key pitfalls along the way.

- Big-picture knowledge. In addition to leading the work at hand, we help organizations choose the right automation technology (rather than the one an employee happens to be familiar with) and avoid longer-term problems like vendor lock-in.

But that’s just the beginning of why bringing on Apexon team is such an impactful way for insurance companies to start the digital transformation journey. We don’t just complete an automation project and walk away; instead, we position your team to continue innovating after our project ends.

How an External Team Can Spark Internal Transformation

Think of your Apexon partner team as a catalyst.

Our approach to automation projects is to enable the greatest success for an organization for the project at hand and to help them build their own capabilities for the future.

We do that by working as a blended team with your in-house employees to build an internal knowledge base, plus automation muscle and experience so they can scale and accelerate the work we started long after we’re gone.

Here’s how that might look in the example from the intro:

- Apexon’s team leads the effort to unify internal and third-party data and develops customer AI to interpret the data and identify potential claim events before FNOL.

- Apexon implements conversational AI that is able to understand and interpret your agent’s conversation with the customer and kick off automated processes in the background.

- Process automation technologies take care of all the data keying, transcribing, and service ordering within your existing systems, allowing your people to focus on what people do best – managing relationships.

In other words, by bringing in external experts, you can jumpstart your organization’s digital transformation and position yourself to confidently continue updating your platform as your organization and the industry evolve.

The combination of our high-level vantage point and extensive experience and your team’s deep industry knowledge is potent: together, we can achieve far more than would be possible for either of us to execute alone.

And because our team is on a fixed timeline, we won’t get pulled into a different project halfway through, meaning the automation project at hand will actually get finished and start impacting your bottom line.

To Compete in a Changing Space, Insurance Companies Can Lean on Outside Talent

The subtext to all this, of course, is the looming presence of insurtech startups. In 2011, investment in insurtechs totaled $140 million. Last year, that number had skyrocketed to $18.3 billion.

The message is clear: the future of insurance is far more tech-forward than its past (or its present).

To stay competitive in this rapidly changing space, incumbent insurance companies can leverage the skills and expertise of an external team like Apexon’s to jumpstart their internal innovation.To find out what that might look like at your organization, set up a conversation today.

![5 Ways Automation Humanizes the Workplace [Plus 1 Bonus]](https://s40886.pcdn.co/wp-content/uploads/2022/06/AdobeStock_411736181-scaled-1.jpeg)