Revolutionizing AML Risk Assessment: A Data-Driven Approach

In 2023 alone, financial institutions globally faced over $10 billion in fines for non-compliance with Anti-Money Laundering (AML) regulations. For banks, AML is no longer just a regulatory obligation—it’s a critical safeguard against significant financial and reputational risks. One area that demands immediate attention from regulators is enterprise-wide AML Risk Assessment. More than just ticking a box, effective AML Risk Assessment is essential for protecting a bank’s financial health, ensuring compliance, and maintaining customer trust. By identifying high-risk areas, banks can allocate resources efficiently and implement controls to prevent money laundering activities.

To establish a sound and proactive risk assessment framework, banks need data-driven solutions that leverage advanced analytics and automation. Drawing on regulatory guidance and our extensive expertise in data solutions, Apexon has developed the AML Risk Assessment Framework, designed to streamline the risk assessment process by centering data as the core of the solution. The RA Framework is a customizable and scalable solution tailored to meet the specific needs of each bank, allowing them to adapt seamlessly to regulatory changes. It integrates data governance, quality, and auditability with the bank’s existing data ecosystem, minimizing technical debt during platform modernization, all while enabling proactive risk management.

Also Read: Ethical AI in Banking and Finance: Balancing Innovation with Responsibility

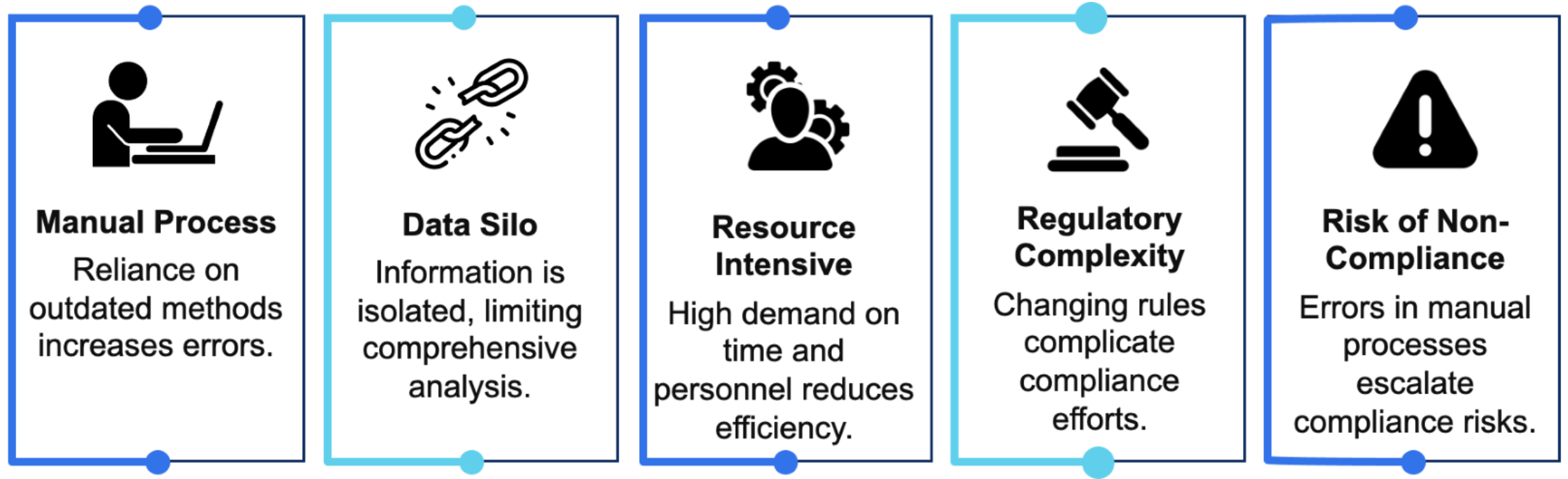

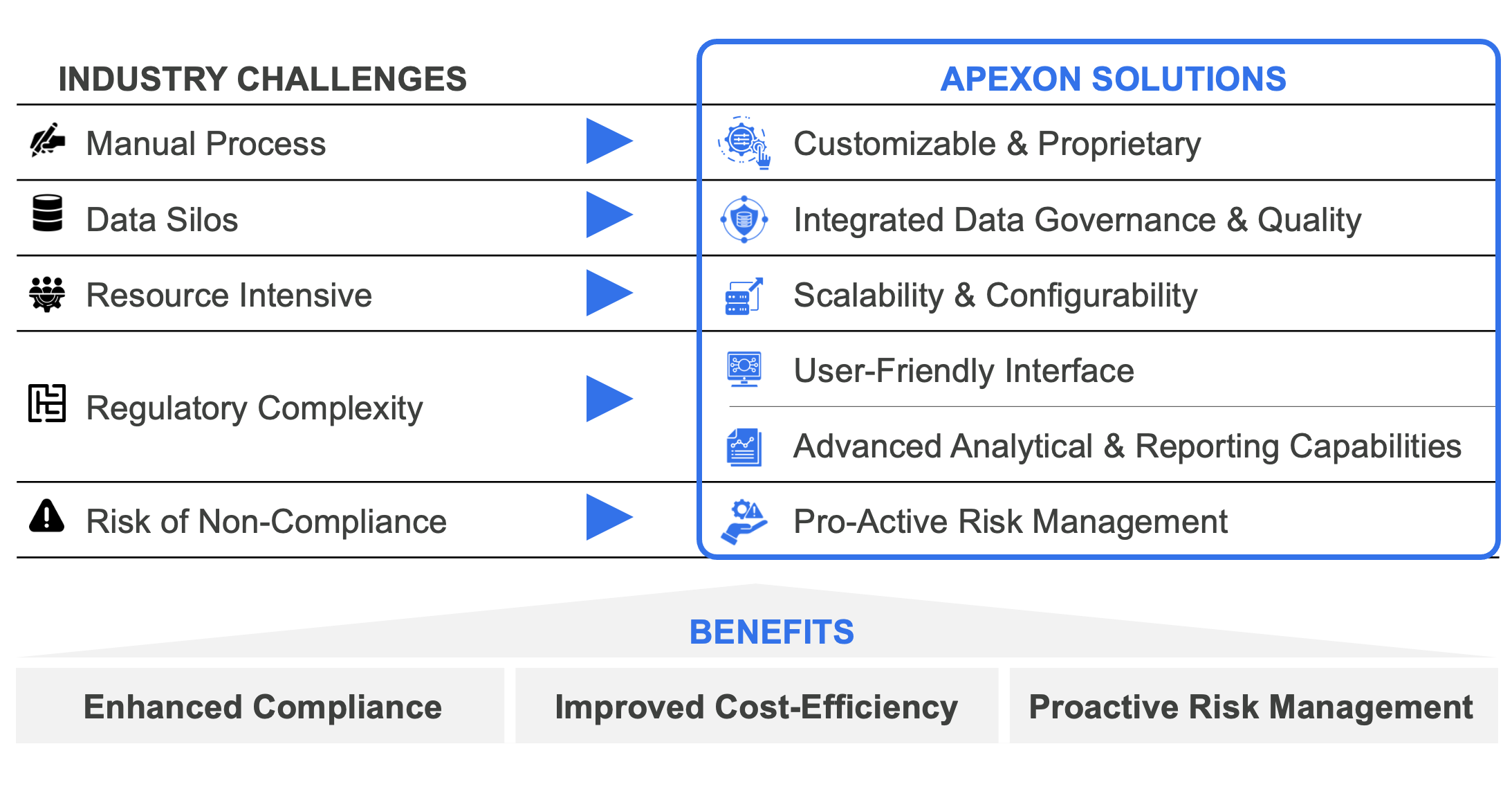

INDUSTRY CHALLENGES

The process of identifying inherent risk, performing controls assessment, and calculating residual risk is fundamental to risk management in banks. These concepts allow banks to understand and assess the risks they face and implement appropriate controls to mitigate those risks. However, the sheer amount of business units and extensive data required to systematically perform risk assessment present significant challenges.

Also Read: The Rise of Real-Time Payments: The Three I’s for a Seamless Experience

- Manual Processes: The current risk assessment process in most banks is highly manual with reliance on rudimentary tools to calculate risk. This approach requires significant manual input of large volumes of data, making the process not only time-consuming but also prone to human error, leading to operational ineffectiveness.

- Data Silos: The reliance on manual tools often results in data silos, where critical information is isolated within different departments or systems. This fragmentation makes it difficult to get a holistic view of the bank’s risk profile.

- Resource Intensive: The manual nature of the current processes means that a significant amount of resources—both time and personnel—are required to manage the risk assessment process. This leads to inefficiencies and higher operational costs.

- Regulatory Complexity: The regulatory environment for banks is constantly evolving, with increasingly stringent requirements being imposed on financial institutions. With unstructured data and a highly manual process, there is an added layer of complexity which makes it difficult for banks trying to ensure they remain compliant across multiple jurisdictions.

- Risk of Non-Compliance: With the growing volume of transactions and the increasing sophistication of financial crime, the risks associated with non-compliance have never been higher. The manual nature of current risk assessment processes increases the likelihood of errors, which can lead to gaps in compliance, potentially resulting in severe financial penalties, reputational damage, and legal consequences for the bank.

Also Read: Streamlining Cross-Border Payments with ISO 20022 Standards

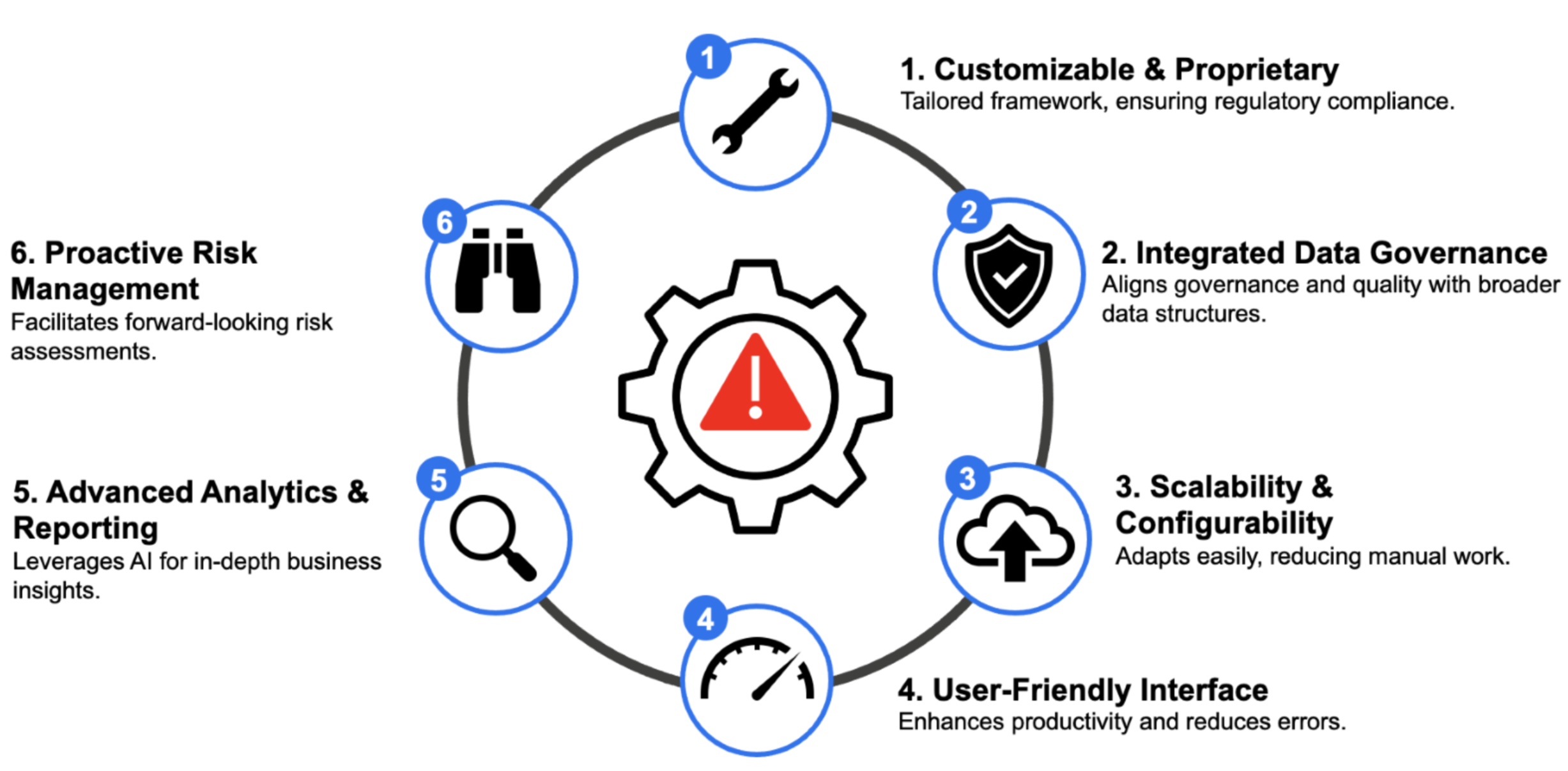

Apexon’s AML Risk Assessment Framework

Building an automated and efficient risk assessment framework is vital to a Bank’s risk management capabilities as well as addressing its regulatory needs. It is essential to modernize the RA platforms by monetizing on accurate and high-quality data. Keeping data as the cornerstone of the solution, the below are the immediate benefits for banks:

- Customizable & Proprietary: The RA Framework is proprietary to each bank, offering full customization that enables banks to control and adapt to regulatory changes seamlessly. This ensures that the solution remains relevant and effective as regulations evolve.

- Integrated Data Governance & Quality: The framework fully integrates data governance, quality, and auditability, aligning effortlessly with the bank’s broader data ecosystem, including data governance, master data management (MDM), data quality (DQ), and metadata structures. This integration eliminates technical debt during platform modernization, ensuring that the bank’s data infrastructure remains robust and future-proof.

- Scalable & Configurable: The framework provides a highly scalable and configurable platform that streamlines key risk assessment processes, significantly reducing or even eliminating manual intervention. Additionally, it can be easily extended for additional control evaluations at the bank with minimal enhancements, ensuring flexibility and adaptability.

- User-Friendly Interface: Designed with all stakeholders in mind, the framework offers a user-friendly interface that enhances time efficiency and reduces human error. The automated, end-to-end data feeds ensure a seamless experience, enabling stakeholders to focus on higher-level tasks rather than manual data processing.

- Advanced Analytical & Reporting Capabilities: The framework can be augmented with advanced analytical, reporting, and Generative AI (GenAI) capabilities, providing granular business insights. These features empower banks to make informed decisions based on comprehensive data analysis.

- Proactive Risk Management: With structured data, the framework also provides the ability to perform ad-hoc assessments, allowing banks to proactively manage risk. This feature is crucial for addressing emerging threats and adapting to rapidly changing risk landscapes.

Also Read: Credit Card Competition Act and the Evolving Payment Landscape

BENEFITS TO BANKS

The future is arriving faster than most banks can keep up with, making it crucial for banks to adopt a data-focused approach to their operations. By building the right data foundation, banks can establish the frameworks necessary to ensure future scalability, enhanced compliance, improved cost-efficiency, and proactive risk management. Moreover, this foundation enables the utilization of advanced analytics for more informed decision-making.

Central to this future is the integration of advanced data analytics tools that can continuously monitor large volumes of transactional and customer data in real-time. Predictive analytics and machine learning models are vital for anticipating and responding to emerging threats. Seamless data integration across all operations provides a unified view of risks, ensuring compliance and proactive risk management

The future of risk assessment is built on data. Apexon is your partner to get there.