Released to market 12 months faster than originally projected

–>

This website uses cookies to offer you the best experience online. By continuing to use our website, you agree to the use of cookies. If you would like to know more about cookies and how to manage them please view our Privacy Policy & Cookies page.

Success Story BFSI

Insurance brokerage firm operationalizes new business via Cloud-Based Platform

This large, privately-held insurance brokerage firm provides insurance, risk management, employee benefits and retirement services. The company has expertise in insurance technology services and leverages a flexible, cloud-based, advanced analytics platform to serve to businesses around the globe. Its risk management services include analytics, strategic risk consulting, supply chain risk, and transaction advisory practice.

Apexon began its strategic partnership with the company in 2018. The client’s goal was to become a “data-powered” company to help adapt to its changing market space and monetize various data assets across its environment. The relationship included enterprise data lake development, data engineering, and quality engineering services with the end goal of establishing a scalable environment to support multiple products/applications, carrier onboarding, and BI self-service for internal reporting.

$39.5B in annual insurance premiums

65,000 clients in over 125 countries

8,500 associates

One of Fast Company’s ‘World’s Most Innovative Companies’

Released to market 12 months faster than originally projected

–>

Support for all preferred payment methods; built to accommodate each bank and retailer’s unique needs

–>

Support for all preferred payment methods; built to accommodate each bank and retailer’s unique needs

–>

Enabled banks and retailers to incorporate value-added services of their own such as loyalty programs and couponing

–>

A single, comprehensive, and multi-channel cloud-based payments system integrated easily with existing payment infrastructure

–>

Accelerating the delivery of new digital initiatives with confidence

Creating the infrastructure and foundation to scale digital initiatives

Leveraging data and analytics to continuously improve digital delivery processes

The company wanted to fundamentally change its business model. This required a new cloud-based enterprise platform solution that would help the company and its partners simplify the delivery of insurance, risk management, employee benefits, and retirement services in an infinitely scalable environment.

The company needed a highly qualified cloud and data engineering partner to collaborate with that could help deliver on its vision. Its specific goals included:

Building a modern digital platform on Azure cloud, while easing the transition from its existing legacy-based systems

Supporting new market demands across a range of customers (both B2B and B2C)

Enabling customers to optimize the performance of their insurance processing operation plans and support better cost management

Providing consumption details with elaborate and fully accurate reports and visualization tools to support the business

Building a flexible, self-service platform for its customers adding transparency for both clients and their employees

Making the company more agile and efficient

The Apexon team has been working with the company since 2018 to eliminate challenges associated with legacy claim processing systems and antiquated business models.

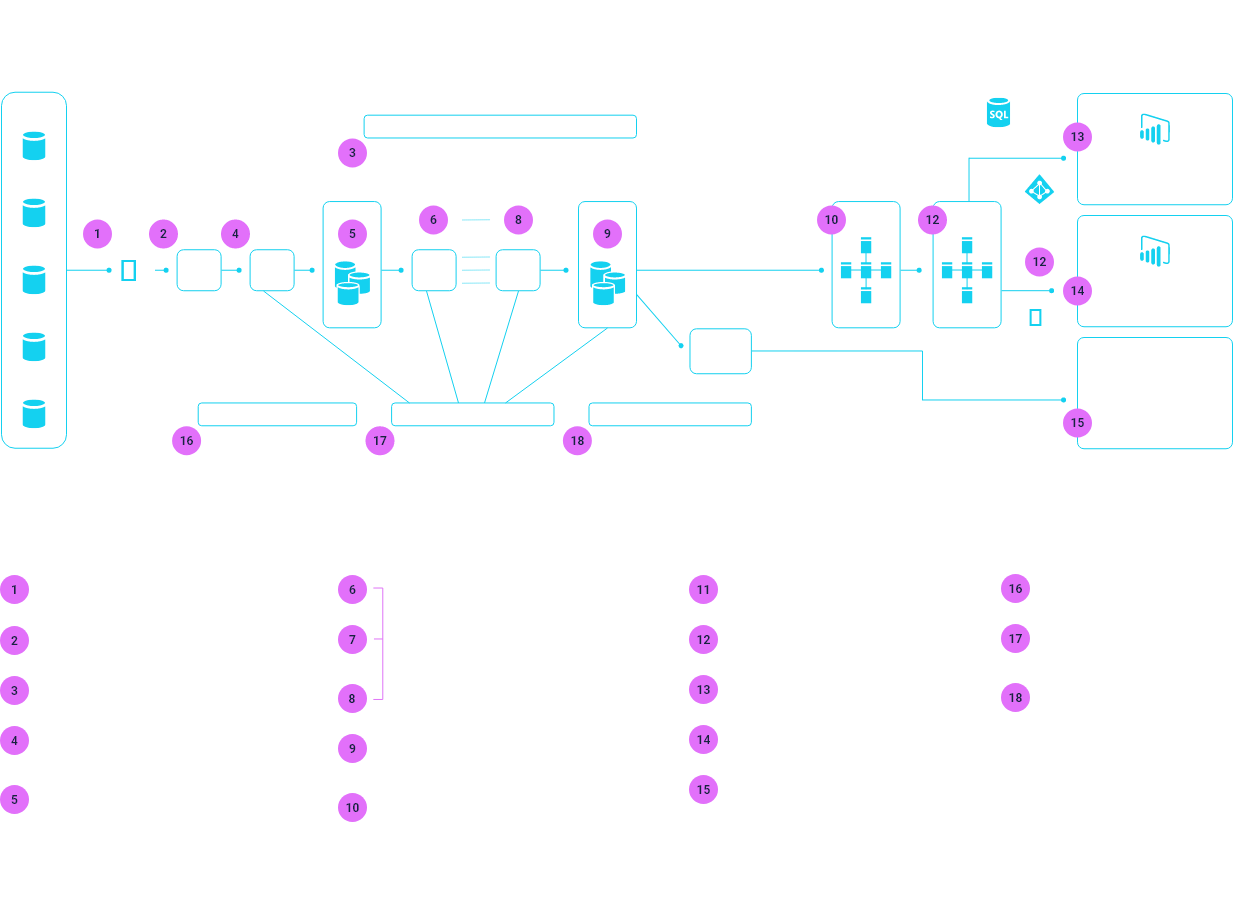

As the company’s dedicated cloud/data engineering partner, Apexon built a Spark-based processing framework for this organization that is based on Apexon’s IC4 methodology. This framework helps to automatically ingest carrier provider/end user (insurance, third-party agents) data from multiple external source systems. The solution transforms the data and loads into SQL server on cloud, for consumption by power BI reporting.

Apexon is working closely with this company’s product and engineering teams to build, scale-up, and continuously innovate and transform the technology platform.

Additionally, the Apexon team is helping the company automate many of its manual legacy business processes related to data strategy and governance.

The enterprise data lake enables the re-use of defined frameworks incorporated into the approval/denial analytics platform to deliver core foundational capabilities that include:

Parameterized Type 2 processing with optimum resource utilization

Complex code generation for curation layers and across the data store

A comprehensive model to store metadata, data quality, and operational metadata

A platform-agnostic engine that validates data at rest and data in motion for completeness, validity, consistency, timeliness, and accuracy

Apexon also recommended the company integrate a cloud-based data warehouse and data analytics solution built on Azure to deal with its growing data management needs.

Modern architecture with predictable batch execution framework driven by Apexon data services and framework on Azure

Monitoring tools, operational dashboard, and security tools provide complete control and visibility in the environment

Scalable environment to support other products/applications, next 20+ carrier onboarding, BI self-service for internal reporting, data scientists, and API framework

Apexon is ingesting insurance data to Azure SQL server storage using Spark processed data based on IC4 methodology. Responsibilities related to this recommendation included project definition, tool selection, execution, transformation, mitigation strategy, execution, testing, and verification. This project will enable the company to lower infrastructure management costs while increasing data storage performance and resilience.

Apexon designed the underlying data architecture for the market analytics platform. This included a scalable, HDinsight-based file system and data analytics solution built on Spark.

New adjudication engine accelerates insurance processing by integrating a solution that was easy to configure, manage and onboard

Efficient provisioning of reporting services and analysis data for consumption by business

Increased automation, agility and scale; easy access to performance data, reduced regression times – all make it possible for client to achieve monthly and weekly releases, working to achieve on-demand releases

Target to reduce insurance processing time on new SQL server cloud platform

To support exponential growth