To effectively brainstorm and prioritize potential applications, it’s essential to actively engage stakeholders from various levels of the organization, including those with technical expertise, business analysts, and customer insights. After generating a diverse set of ideas, the next step is to evaluate and rank them based on feasibility—considering factors such as technological requirements, resource availability, and implementation challenges—as well as their potential impact on the organization’s goals, customer experience, and competitive advantage. This prioritization helps focus efforts on

the most promising applications, ensuring that resources are allocated efficiently and effectively to initiatives that offer the highest return on investment and strategic value.

Gaining management support for implementing innovative technologies like AI requires a strategic approach that aligns with overarching business goals. Presenting a compelling business case to executives is crucial. This involves clearly articulating the potential return on investment (ROI) and benefits, such as enhanced efficiency, improved customer satisfaction, and competitive advantages that the AI initiative can bring. It’s essential to demonstrate how the AI strategy not only supports but also amplifies the current business direction, showing its potential to drive growth, optimize operations, and mitigate risks. By highlighting concrete examples of how AI can solve existing business challenges or capitalize on new opportunities, you can make a persuasive argument for its adoption. Ensuring that the AI strategy is in harmony with the company’s vision and objectives will facilitate executive buy-in, securing the necessary support and resources for successful implementation.

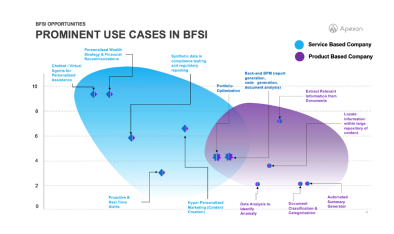

Understanding the risks and establishing a solid business foundation are critical steps in leveraging new technologies or strategies effectively. This involves a thorough analysis of data privacy and regulatory implications, particularly in sectors like BFSI, where compliance with laws and standards is non-negotiable. Companies must assess the costs and projected returns of their initiatives, ensuring that the investment aligns with market demand and the potential for profitability. It’s also vital to understand the competitive landscape, identifying how these initiatives can provide a competitive edge, such as through improved customer experiences, enhanced operational efficiencies, or innovative product offerings. By addressing these aspects comprehensively, businesses can mitigate risks, make informed decisions, and lay down a robust foundation that supports sustainable growth and success in the face of technological advancements and market changes.

Choosing the most impactful use case and validating its feasibility is a pivotal step in maximizing the benefits of any new initiative, especially in technologically driven projects. The selected use case must closely align with the company’s strategic goals, ensuring that it contributes directly to the overarching objectives and long-term vision of the organization. Assessing technical feasibility is equally critical; it’s essential to determine whether the current technological infrastructure can support the initiative or if upgrades and investments are needed. Additionally, a thorough evaluation of the necessary resources, including budget, personnel, and time, is crucial for successful implementation. Considering these factors allows organizations to set realistic timelines and expectations, mitigate risks, and ensure that the chosen use case can be effectively integrated into the

business operations, thereby delivering tangible value and driving progress towards strategic milestones.

Establishing the necessary technical infrastructure is a foundational step for successfully integrating AI into business processes. This involves selecting the appropriate AI frameworks and tools that align with the project’s objectives and technical requirements. The choice of technology should not only cater to current needs but also be flexible enough to accommodate future expansions and advancements. Setting up efficient data pipelines and secure, scalable storage solutions is crucial for managing the vast amounts of data that AI systems require for training and operation. Prioritizing scalability and robustness in the infrastructure design ensures that the system can handle growing data volumes and complexity without compromising performance. Moreover, a robust infrastructure supports continuous improvement and iteration of AI models, enabling businesses to stay competitive and responsive to market changes and technological innovations.

Designing, training, and refining an AI model is a meticulous process that begins with the careful design of the model architecture. This initial step involves selecting the appropriate algorithms and structures that align with the project’s specific requirements and objectives. Once the architecture is in place, the model undergoes a rigorous training process, utilizing relevant datasets to learn and adapt. This phase is followed by thorough testing and validation to ensure the model performs accurately and efficiently against predefined criteria and real-world scenarios. However, the development cycle doesn’t end here. Iteration based on feedback and performance metrics is crucial. Continuous refinement, driven by real-world application feedback and evolving performance metrics, ensures the AI model remains effective, efficient, and aligned with the changing dynamics of its application environment. This iterative cycle of design, training, testing, and refinement is fundamental to developing a robust, reliable AI system that meets the intended goals and adapts over time.

Integrating the generated AI model into real-world applications necessitates several strategic procedures to assure its efficacy and efficiency. The first stage is to integrate the model into the current systems and infrastructure, which needs careful design and execution to assure compatibility and smooth operation. Following integration, the model must be carefully evaluated in real-world situations to confirm its performance and dependability under realistic operational settings. This phase is crucial for detecting flaws and opportunities for improvement prior to full-scale implementation. Furthermore, regular monitoring of the model’s performance after deployment is required. This enables the identification and rectification of any new faults and continuous optimization to improve efficiency, accuracy, and effectiveness. Such diligent implementation and maintenance processes are crucial for leveraging the full potential of AI models in solving real-world problems and achieving business objectives.